Every day that a sales order sits on a desk or an invoice waits for a physical signature, your company is paying an invisible tax. It isn’t a tax you’ll find in a government handbook, but your competitors aren’t paying it, and your CFO definitely won’t like seeing it on the balance sheet once they realize it’s there.

In the current economic climate, many leadership teams view digital transformation as a “nice-to-have” IT project. But let’s be honest: manual accounts payable (AP), bill of lading (BOL), and sales order processing have become significant financial liabilities. To win over a CFO, you have to move beyond the idea of “going green” or “being more organized”. You need to demonstrate how automating document workflows directly impacts the bottom line by accelerating cash cycles and eliminating operational friction. For a deeper dive into these financial strategies, you may want to review The Strategic CFO’s Guide to AP Automation.

In this guide, we’ll break down the three pillars of a winning CFO pitch: quantifying the “paper tax,” proving cash flow acceleration, and de-risking the investment through expert implementation.

1. Quantifying the “Paper Tax”: Beyond the Cost of a Ream

When most people think of “paperless,” they think of saving money on printer ink and stationery. To a CFO, those are rounding errors. The real “paper tax” is hidden in your labor and error rates.

The Hidden Labor Cost

Think about the hours your team spends on manual data entry, filing, and hunting down lost BOLs or invoices. Those minutes add up to a massive overhead.

- The Math: Industry studies show it costs nearly $10 to process a single paper invoice.

- The Automated Alternative: When you switch to an automated system, that cost can drop to approximately $2.81 per invoice. See pages 12 and 21 of this report.

The Error Multiplier

Manual entry isn’t just slow; it’s risky. Errors in Sales Orders and Purchasing lead to “re-work,” which is a silent profit killer. When a human makes a typo on a sales order, the wrong product goes out, the warehouse has to handle a return, and the customer is frustrated. That’s a triple hit to your margins.

Addressing the “Sunk Cost” Counterargument

You might hear a CFO say, “Our staff is already paid; why does their time matter?”. This is where you talk about Opportunity Cost. If your AP team is 50% more efficient because they aren’t typing in data, they can pivot to high-value tasks like vendor negotiations and capturing early-payment discounts. You aren’t just saving time; you’re reallocating talent to areas that actually grow the business.

2. Accelerating the Cash Cycle: The CFO’s North Star

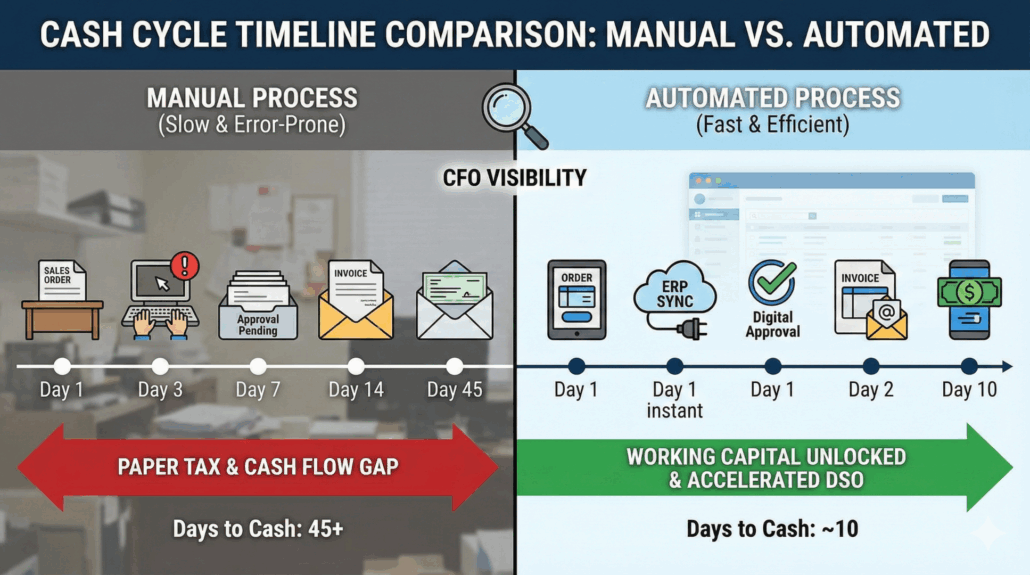

If you want a CFO’s undivided attention, talk about cash flow velocity. Specifically, focus on how manual processes act as a brake on your company’s “North Star” metrics: DSO and DPO.

DSO and DPO Optimization

Automated Sales Order processing reduces Days Sales Outstanding (DSO). By getting orders to the warehouse faster, you get products out the door and invoices into the customer’s hands sooner. On the flip side, better visibility into your AP allows you to manage Days Payable Outstanding (DPO) more strategically, ensuring you keep cash in the business for as long as possible without missing discount windows.

The BOL Bottleneck

One often-overlooked area is the Bill of Lading (BOL). Delays in BOL processing create a lag in billing. Effectively, every day a BOL sits unprocessed, you are providing an interest-free loan to your customers at your company’s expense. Automated freight process automation closes this gap immediately.

ERP Integration as a Force Multiplier

A standalone tool is just another silo. The real value comes when document automation “plugs into” your existing ERP. Mosaic’s ability to integrate ensures data flows into the system of record in real-time. This gives the CFO instant visibility into liabilities, rather than waiting for month-end reports that are already outdated by the time they’re printed.

Visual Tip: Imagine a side-by-side “Cash Cycle Timeline.” On one side, you have the manual trail (mailing, physical signatures, manual entry). On the other, the automated trail (instant capture, digital routing, ERP sync). The difference in time is the difference in your bank balance.

3. De-Risking the Transition: The Mosaic Advantage

CFOs are naturally skeptical of software. Their biggest fear is “Shelfware”—investing in expensive software that no one actually uses because it’s too complex or doesn’t fit the workflow.

Expert-Led Implementation

Mosaic doesn’t just hand you a login and wish you luck. We position our implementation experts as the bridge between the technology and your desired outcomes. We understand the cultural adoption challenges that come with changing how people work, which is why we focus heavily on The Psychology of AP Automation: Overcoming User Resistance.

Success in Action

We’ve seen this work in the real world across diverse environments. For example, one organization integrated document automation with their ERP specifically to solve a warehouse picking lag. By digitizing the workflow, they allowed the warehouse to move at the speed of their digital orders, a strategy you can see mirrored in our Scaling Document Management: Multi-Location Success Stories.

Digitizing the “Signature Trail”

Beyond efficiency, there’s the matter of compliance and auditability. Automated workflows provide an immutable audit trail. When the annual financial audit rolls around, you aren’t digging through filing cabinets. You’re handing over a clean, digital record that reduces both the cost and the risk of the audit process.

Your Integration Checklist

For a rollout to be seamless, your solution must hit these points:

- Real-time sync with the system of record (ERP).

- Automated data capture (eliminating manual entry).

- Digital approval workflows for remote team support.

- Full auditability for every document touchpoint.

The Bottom Line: Moving From Cost Center to Strategic Asset

At the end of the day, your CFO isn’t focused on the mechanics of a scanner or the specific layout of a digital web form. Their priority is the velocity of your company’s cash and the reliability of the data used to make decisions. By framing document automation as a strategic initiative to unlock working capital rather than a simple IT upgrade, you shift the conversation from “spending money” to “investing in growth”.

Mosaic understands that every organization has a unique culture and existing ERP infrastructure that must be respected during this transition. We don’t just provide a tool; we act as a bridge between your current manual friction and your future digital efficiency. Failing to automate isn’t a neutral stance; it is a choice to continue paying a “Paper Tax” that compounds over time, slowing down your operations and creating unnecessary cash flow gaps.

Let’s Build Your Business Case Together

Ready to stop the manual data entry and start seeing measurable ROI? We offer several ways to help you prove the value of automation to your leadership team. Contact Mosaic today to embark on your digital transformation journey and empower your business.